What is Life Insurance and Why Should I Get It?

September 17, 2025

How Are Life Insurance Premiums Calculated? What Factors Affect Them?

September 17, 2025Comprehensive Guide to Life Insurance

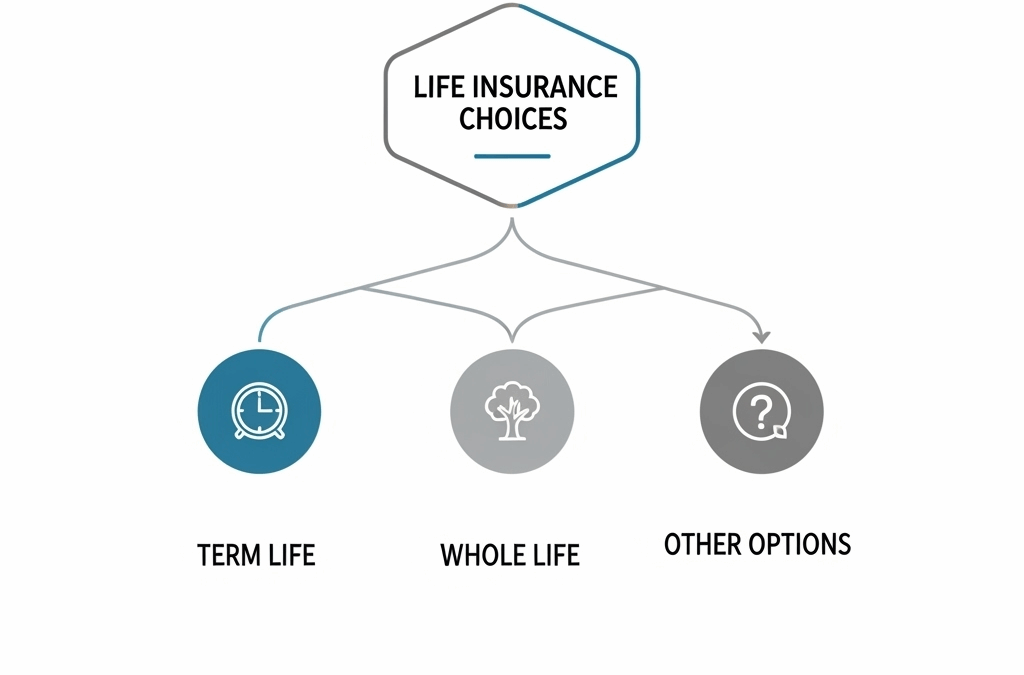

Life insurance is not a one-size-all product. There are different types to suit your needs and budget. Here are the most common ones and their benefits:

- Term Life Insurance: This policy is valid for a specific period (e.g., 10, 20, or 30 years). If a risk does not occur within this period, the policy expires, and premiums are not refunded. It is ideal for those who want high coverage at low premiums.

- Whole Life Insurance: This policy is valid for your entire life and offers a savings component. A portion of your premium goes toward risk coverage, while the rest is directed to a savings account. This is a suitable option for those looking for long-term savings and leaving an inheritance.

- Credit Life Insurance: This is often a mandatory or recommended type of insurance for long-term loans, such as mortgages. In the event of your death, it ensures that the remaining debt is paid by the insurance company, preventing your heirs from inheriting the debt.